RETROECONOMIC BARRIERS IN THE DEVELOPMENT OF AN INNOVATIVE ECONOMY

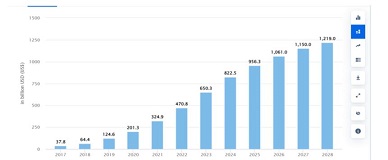

Загрузки

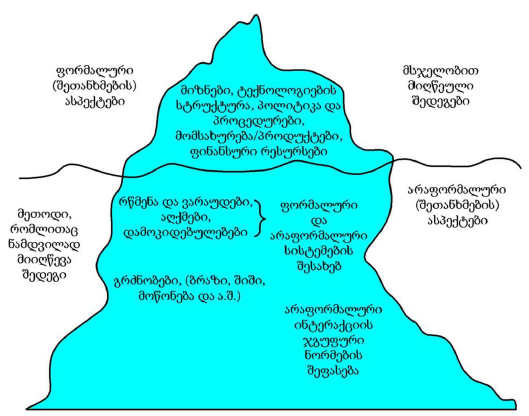

This paper explores the challenges of fostering an innovative economy in the context of technological underdevelopment. Enterprises relying on outdated technologies constitute the structural core of what may be termed a retroeconomy. In many developing countries, the persistence of obsolete production technologies remains widespread, often giving the misleading impression of enterprise viability and economic success. However, such retroeconomic firms lack competitiveness in the global marketplace. Addressing the adverse implications of retroeconomy requires a proactive and strategic role from the government, particularly through targeted innovation policies and support for technological modernization.

JEL Classification: D21, D24, D42, G33, L26, L51, L53, O32, O34, O38

Скачивания

Ahearne, A. G. and N. Shinada. (2005). “Zombie Firms and Economic Stagnation in Japan.” International Economics and Economic Policy, 2 (4): 363–381.

Anderson, R. E. (2004). Get Out of the Way: How Government Can Help Business in Poor Countries. Washington, D.C.: CATO Institute.

Baker D. (2023b). “Professor Stiglitz’s Contributions to Debates on Intellectual Property.” Real-World Economics Review, (105): 12–24, <https://www.paecon.net/PAEReview/issue105/whole105.pdf>.

Balatskiy, E. V. (2003). “Ekonomicheskij rost i tekhnologicheskie lovushki [Economic Growth and Technological Traps].” Obshchestvo i ekonomika [Society and Economy], 11: 53–76. (In Russian.)

Balatskiy, E. V. (2010). “Rol’ optimizma v innovatsionnom razvitii ekonomiki [The Role of Optimism in the Innovative Development of the Economy].” Obshchestvo i ekonomika [Society and Economy], 1: 3–20. (In Russian.)

Balatskiy, E. V. (2012). “Institutsional’nye i tekhnologicheskie lovushki [Institutional and Technological Traps].” Zhurnal ekonomicheskoij teorii [Journal of Economic Theory], 2: 48–63. (In Russian.)

Barro, R. J. and X. Sala-i-Martin. (2004). Economic Growth. Cambridge: MIT Press.

Bresis, E., Krugman, P. and R. Tsiddon. (1993). “Leapfrogging in International Competition: A Theory of Cycles in National Technological Leadership.” American Economic Review, 83 (5): 1211–1219.

Catner, U. (2016). “Foundations of economic Change – an Extended Schumpeterian Approach.” Journal of Evolutionary Economics, 26 (4): 701–736.

Chedi, M. K. E. (2015). “Entrepreneurial Features of the Creators of Innovative Enterprises.” International Journal of Economic Practices and Theories, 5 (3): 213–221.

Dementyev, V. E. (2006). “Lovushka tekhnologicheskikh zaimstvovanij i usloviya ee preodoleniya v dvukhsektornoij modeli ekonomiki [A Trap of Technological Adoption and the Terms to Overcome it in the Two-Sectors Economic Model].” Ekonomika i matematicheskie metody [Economics and Mathematical Methods], 42 (4): 17-32. (In Russian.)

Dompe, S. (2014). “Industrial Policy Is Still a Loser.” Mises Daily Articles, July 16, <https://mises.org/mises-daily/industrial-policy-still-loser>.

Foster, R. and S. Kaplan. (2001). Creative Destruction: Why Companies That Are Built to Last Underperform the Market and How to Successfully Transform Them. New York: Currency.

Glazyev, S. (2009). “Mirovoij ekonomicheskij krizis kak protsess smeny tekhnologicheskikh ukladov [World Economic Crisis as a Process of Substitution Technological Models].” Voprosy ekonomiki [Issues of the Economy], 3: 26-38. (In Russian.)

Golichenko, O. (2012). “Modeli razvitiya, osnovannogo na diffuzii tekhnologij [Models of Development Based on Technology Diffusion].” Voprosy ekonomiki [Issues of the Economy], 4: 117–131. (In Russian.)

Harman, C. (2010). Zombie Capitalism. Global Crisis and the Relevance of Marx. Chicago: Haymarket Books.

Hoshi, T. (2006). “Economics of the Living Dead.” The Japanese Economic Review, 57 (1): 30–49.

Howitt, P. (2000). Endogenous Growth and Cross-Country Income Differences. The American Economic Review, 90 (4): 829–846.

Krugman, P. (2020). Arguing with Zombies: Economics, Politics, and the Fight for a Better Future. New York, W. W. Norton & Company.

Lindsey, B. (2002). Against the Dead Hand: The Uncertain Struggle for Global Capitalism. New York: John Wiley & Sons.

Lipowski, A. (1998). Towards Normality. Overcoming the Heritage of Central Plan¬ning Economy in Poland in 1990-1994. Warsaw: Adam Smith Research Center, Center for Social and Economic Research.

Lipton, D. (2016). “China’s Corporate-Debt Challenge.” Project Syndicate, August 18, <https://www.project-syndicate.org/commentary/china-corporate-debt-problem-by-david-lipton-2016-08>.

Murrell, P. (1992). “Evolution in Economics and in the Economic Reform of the Centrally Planned Economies.” In The Emergence of Market Economies in Eastern Europe, ed. by C. Clauge, and G. C. Rausser. Cambidge, M.A. & Oxford, UK: Blackwell Publishers, pp. 35–53.

Nelson, R. R. and S. G. Winter. (1982). An Evolutionary Theory of Economic Change. Cam-bridge: Belknap Press of Harvard University Press.

OECD. (2007). OECD Economic Surveys: India. OECD, Volume 2007/14, October, <https://www.oecd.org/en/publications/oecd-economic-surveys-india-2007_eco_surveys-ind-2007-en.html>.

Onaran, Y. (2012). Zombie Banks. How Broken Banks and Debtor Nations are Crippling the Global Economy. Hoboken: John Wiley & Sons.

Papava, V. (2002). “Necroeconomics – The Theory of Post-Commu¬nist Transforma¬tion of an Economy.” International Journal of Social Economics, 29 (9-10): 796-805.

Papava, V. (2010). “The Problem of Zombification of the Post-communist Necroeconomy.” Problems of Economic Transition, 53 (4): 35-51.

Papava, V. (2015). “Necroeconomics of Post-Soviet Post-Industrialism and the Model of Economic Development of Georgia and Russia.” Journal of Business and Economics, 6 (5): 976-983.

Papava, V. (2017). “Retroeconomics – Moving from Dying to Brisk Economy.” Journal of Reviews on Global Economics, 6: 455-462, <https://www.lifescienceglobal.com/independent-journals/journal-of-reviews-on-global-economics/volume-6/85-abstract/jrge/2929-abstract-retroeconomics-moving-from-dying-to-brisk-economy>.

Papava, V. (2024). From Retroeconomics to Sanctionomics: Essays on Unconventional Economics. Bloomington: iUniverse.

Parente, S. L. and E.C. Prescott. (2000). Barriers to Riches. Cambridge: MIT Press.

Polterovich, V. and A. Tonis. (2010). “Innovation and Imitation at Various Stages of Development: A Model with Capital.” MPRA Paper No. 20244, January 26, <https://mpra.ub.uni-muenchen.de/20244/2/MPRA_paper_20244.pdf>.

Porter, M. E. (1990). The Competitive Advantage of Nations. New York: The Free Press.

Quiggin, J. (2010). Zombie Economics. How Dead Ideas Still Walk Among Us. Princeton: Princeton University Press.

Sachs J. F. (2017). Building the New American Economy. Smart, Fair, and Sustainable. New York: Columbia University Press.

Schumpeter, J. A. [1942] (2008). Capitalism, Socialism, and Democracy. New York: Harper Perennial Modern Thought.

Segerstrom, P. S. (1991). “Innovation, Imitation, and Economic Growth.” Journal of Political Economy, 99 (4): 807–827.

Stiglitz, J. E. (2001). “Bankruptcy Laws: Basic Economic Principles.” In Resolution of Financial Distress: An International Perspective on the Design of Bankruptcy Laws, ed. by S. Claessens, S. Djankov and A. Mody. Washington, D.C.: The World Bank, pp. 1–23.

Stiglitz, J. E. (2016). “Monopoly’s New Era.” Project Syndicate, May 13, <https://www.project-syndicate.org/commentary/high-monopoly-profits-persist-in-markets-by-joseph-e--stiglitz-2016-05?barrier=true>.

Stiglitz J. E. (2023). “Fixing Global Economic Governance.” Project Syndicate, October 23, <https://www.project-syndicate.org/commentary/global-financial-economic-architecture-needs-an-overhaul-by-joseph-e-stiglitz-2023-10?utm_source=Project+Syndicate+Newsletter&utm_campaign=b69308463f-covid_newsletter_10_25_2023&utm_medium=email&utm_term=0_73bad5b7d8-b69308463f-93567601&mc_cid=b69308463f&mc_eid=e9fb6cbcc0>.

White, M. J. (2001). “Bankruptcy Procedures in Countries Undergoing Financial Crises.” In Resolution of Financial Distress: An International Perspective on the Design of Bankruptcy Laws, ed. by S. Claessens, S. Djankov and A. Mody. Washington, D.C.: The World Bank, pp. 25–45.

Copyright (c) 2025 Georgian Scientists

Это произведение доступно по лицензии Creative Commons «Attribution-NonCommercial-NoDerivatives» («Атрибуция — Некоммерческое использование — Без производных произведений») 4.0 Всемирная.