Issues of distribution of tax powers between different levels of government and administration

Downloads

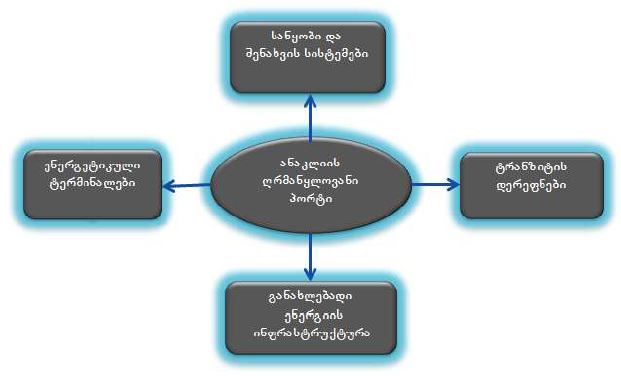

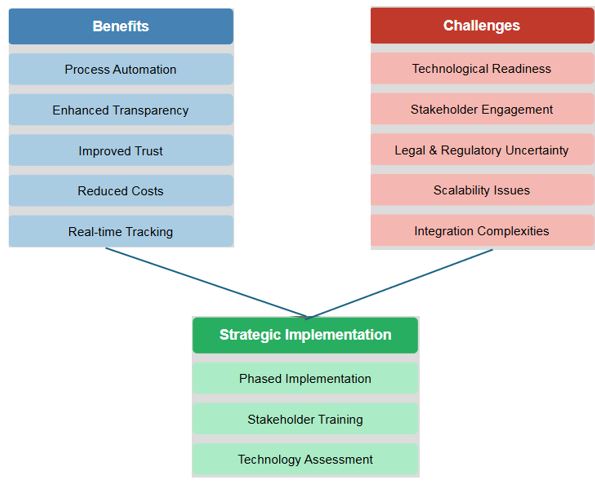

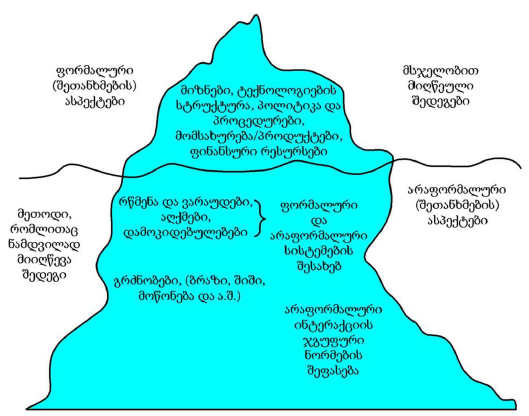

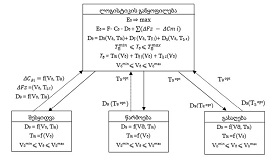

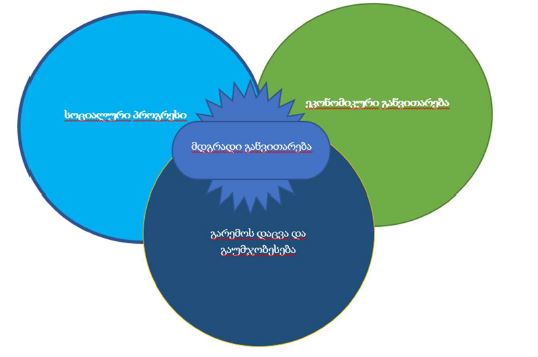

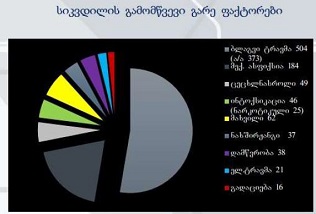

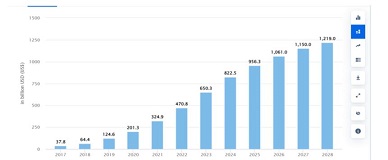

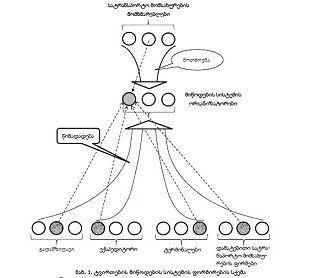

The solution of the tasks of allocating expenditures between the different levels of government and administration is accompanied by the need to make decisions on the redistribution of tax powers between the levels of state government.

A study of international experience in building a vertical structure of tax authorities shows that there is no prevailing strategy for assigning this or that revenue to certain levels of government.

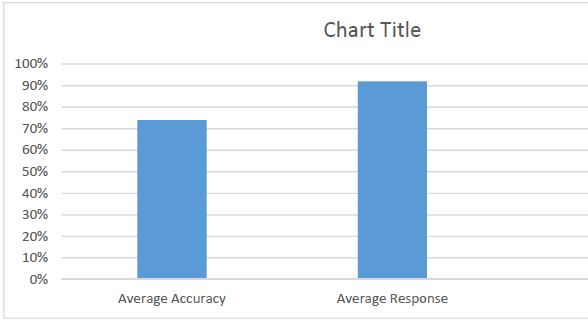

Downloads

Metrics

Copyright (c) 2021 Lela Bakhtadze ლელა ბახტაძე

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.