The Critical Role of Investment Banks in the Sustainable Growth of Emerging Economies: the Case of Georgia

Загрузки

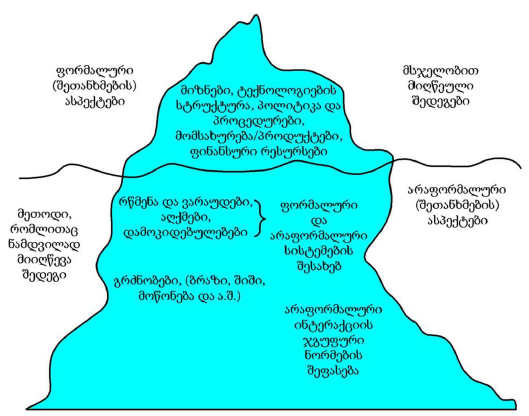

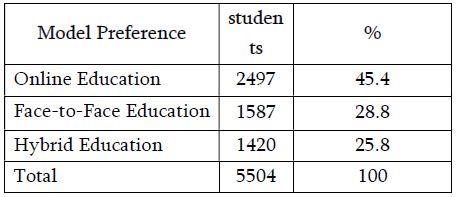

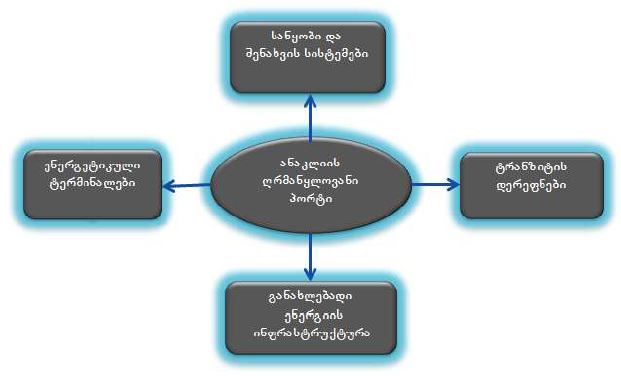

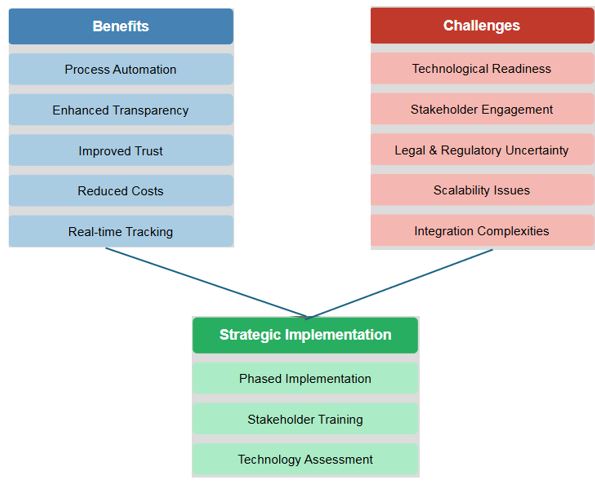

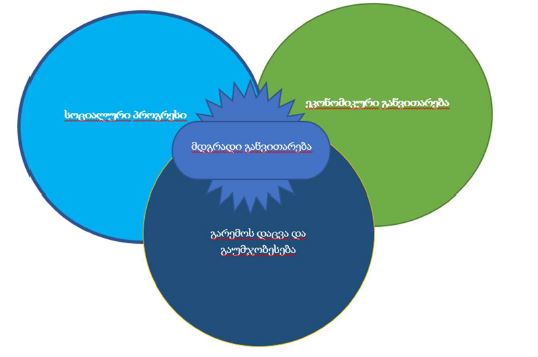

Achieving sustainable economic growth is a major challenge for developing countries. This study aims to assess the role of investment banks in this process, using Georgia as a case study. We hypothesize that sustainable growth requires not only a commercial banking system but also the presence of fully-fledged investment banks that can act as catalysts for structural change. The research is based on literature analysis, an assessment of Georgia's macroeconomic data, and a study of the operations of financial institutions. The theoretical section integrates classical theories of financial intermediation with modern concepts of sustainable finance and ESG (Environmental, Social, Governance) standards. The results show that in Georgia, where the financial sector is based on commercial banks, a fully-fledged investment banking institution is absent. The investment divisions of commercial banks primarily deal with simple securities and do not perform complex functions such as organizing major infrastructure projects, corporate merger transactions, or financing innovative projects. The main reasons for this are: a weak capital market, a lack of specialists, the absence of regulations tailored for investment banking, and a business model dependent on short-term deposits. Conclusion. Achieving sustainable growth requires the establishment of fully-fledged, independent investment banks. This necessitates: introducing specific regulations, deepening the capital market, training personnel, and attracting long-term capital sources. Only under these conditions will Georgia be able to fully utilize the potential of financial innovation for sustainable development.

Скачивания

Allen, F., & Gale, D. (2000). Comparing financial systems. MIT press.

Barth, J. R., Caprio, G., & Levine, R. (2006). Rethinking bank regulation: Till angels govern. Cambridge University Press.

Berk, J., & DeMarzo, P. (2017). Corporate finance (4th ed.). Pearson.

Boot, A. W. (2000). Relationship banking: What do we know? Journal of Financial Intermediation, 9(1), 7-25.

Boot, A. W., & Thakor, A. V. (1997). Financial system architecture. The Review of Financial Studies, 10(3), 693-733.

Boyd, J. H., & Prescott, E. C. (1986). Financial intermediary-coalitions. Journal of Economic Theory, 38(2), 211-232.

Claessens, S., & Klapper, L. (2005). Bankruptcy around the world: Explanations of its relative use. American Law and Economics Review, 7(1), 253-283.

Claessens, S., & Laeven, L. (2003). Financial development, property rights, and growth. The Journal of Finance, 58(6), 2401-2436.

Demirgüç-Kunt, A., & Detragiache, E. (2002). Does deposit insurance increase banking system stability? An empirical investigation. Journal of Monetary Economics, 49(7), 1373-1406.

Demirgüç-Kunt, A., & Levine, R. (2001). Financial structure and economic growth: A cross-country comparison of banks, markets, and development. MIT press.

Diamond, D. W. (1984). Financial intermediation and delegated monitoring. The Review of Economic Studies, 51(3), 393-414.

Esty, B. C. (2004). Modern project finance: A casebook. John Wiley & Sons.

Gurley, J. G., & Shaw, E. S. (1960). Money in a theory of finance. Brookings Institution.

Haselmann, R., Pistor, K., & Vig, V. (2010). How law affects lending. The Review of Financial Studies, 23(2), 549-580.

Levine, R. (2005). Finance and growth: Theory and evidence. In Handbook of economic growth (Vol. 1, pp. 865-934). Elsevier.

Levine, R., & Zervos, S. (1998). Stock markets, banks, and economic growth. American Economic Review, 88(3), 537-558.

Mishkin, F. S. (2001). The economics of money, banking, and financial markets (6th ed.). Addison-Wesley.

Papava, V. (2016). Georgia's economy: Main directions and challenges. Nova Science Publishers.

Peltzman, S. (1976). Toward a more general theory of regulation. The Journal of Law and Economics, 19(2), 211-240.

Rajan, R. G., & Zingales, L. (2003). The great reversals: The politics of financial development in the twentieth century. Journal of Financial Economics, 69(1), 5-50.

Stigler, G. J. (1971). The theory of economic regulation. The Bell Journal of Economics and Management Science, 2(1), 3-21.

საქართველოს ეროვნული ბანკი. (2023). ფინანსური სტაბილურობის ანგარიში 2023. თბილისი.

საქართველოს ეროვნული ბანკი. (2025). მონეტარული პოლიტიკის ანგარიში 2025 წლის პირველი კვარტალი. თბილისი.

World Bank. (2022). Georgia: Financial sector assessment program (FSAP). Financial Sector Assessment Program (FSAP).

Copyright (c) 2025 Georgian Scientists

Это произведение доступно по лицензии Creative Commons «Attribution-NonCommercial-NoDerivatives» («Атрибуция — Некоммерческое использование — Без производных произведений») 4.0 Всемирная.