ბანკში თანამედროვე ინფორმაციული სისტემების და ტექნოლოგიების ეფექტიანობის შეფასება Balanced Scorecard (BSC) მეთოდის გამოყენებით

ჩამოტვირთვები

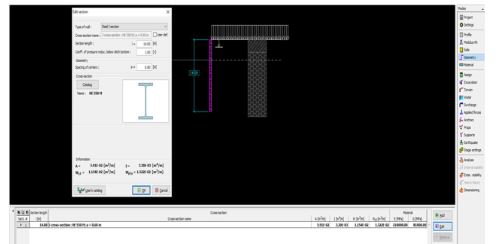

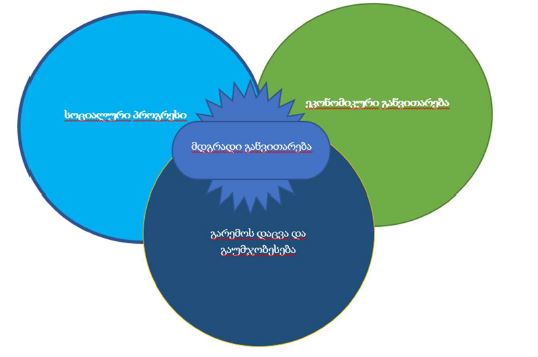

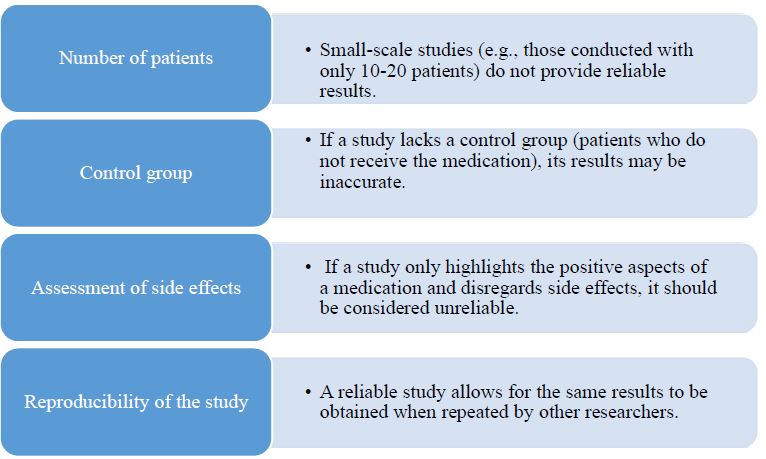

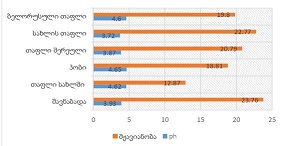

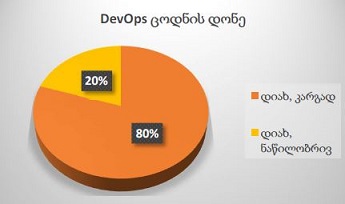

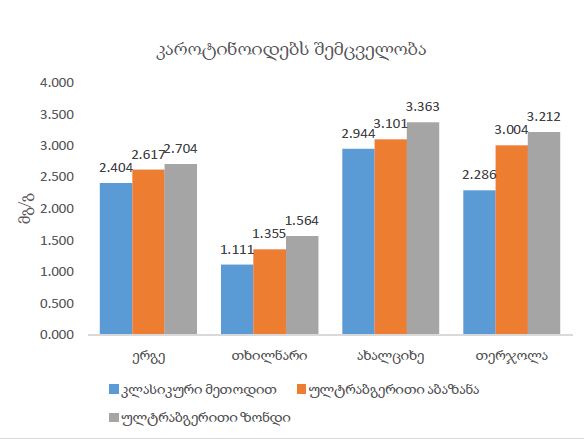

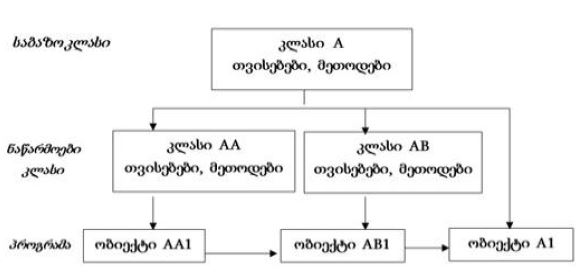

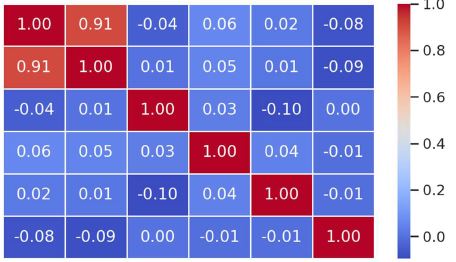

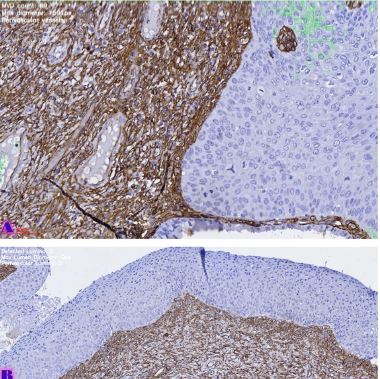

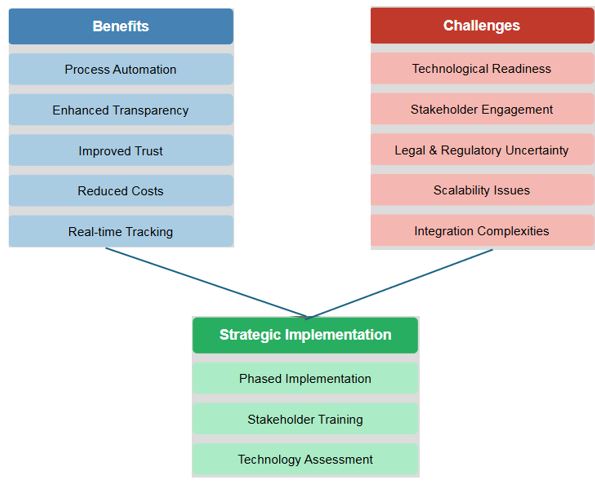

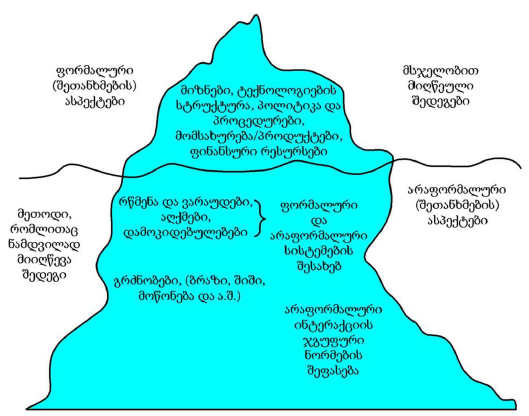

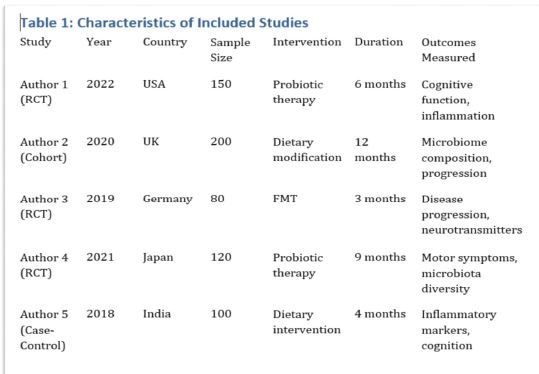

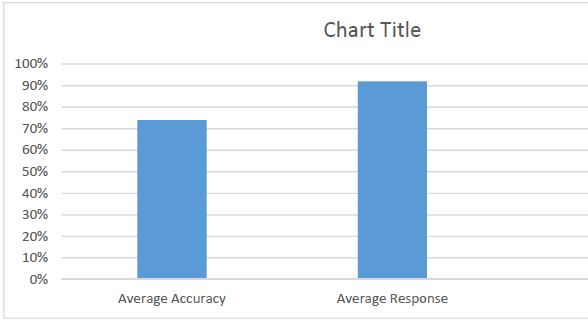

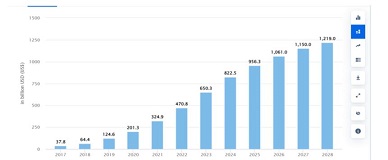

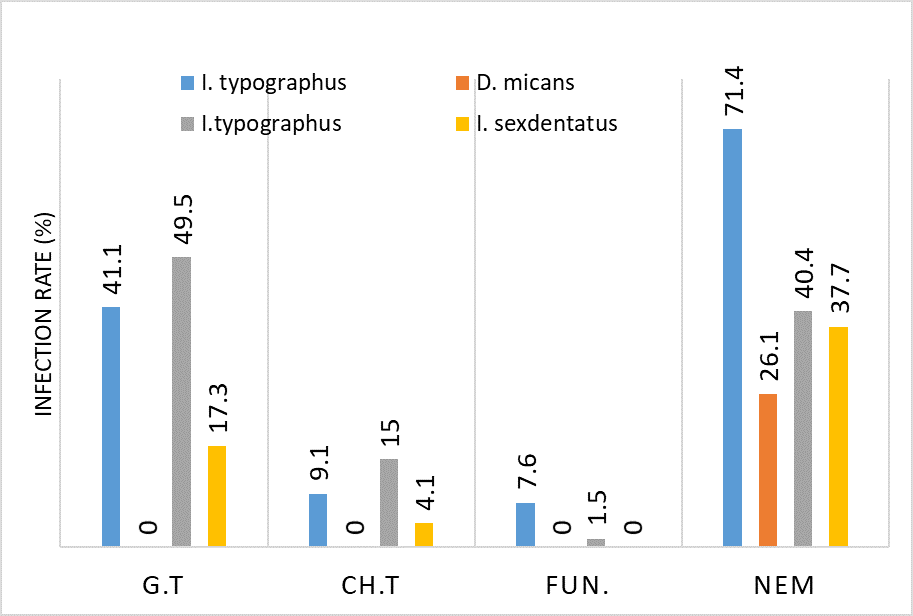

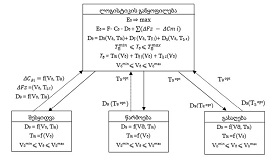

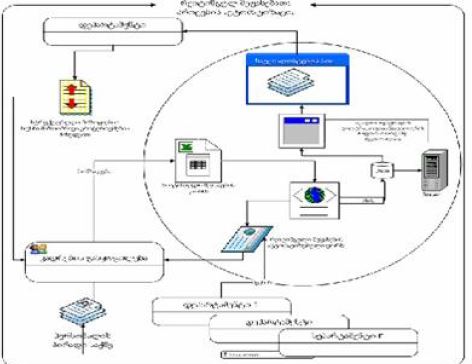

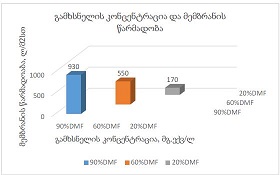

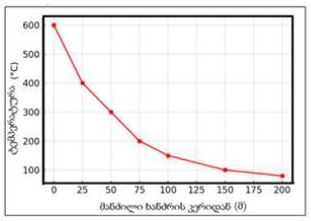

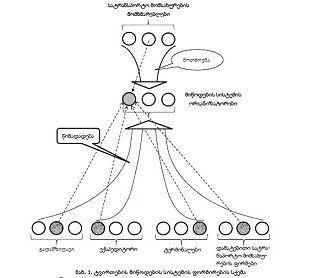

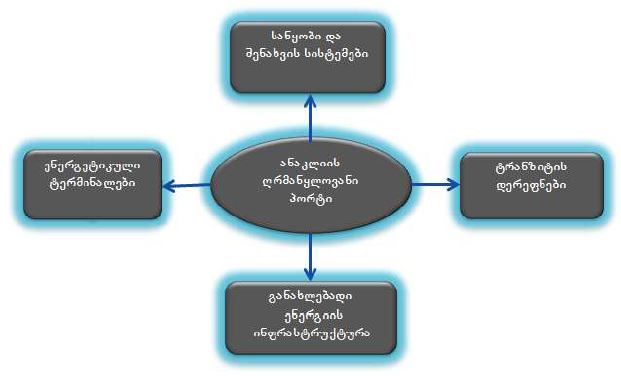

დღეს ბანკში აქტუალურია ინფორმაციული ტექნოლოგიების (IT) ისეთი თანამედროვე მიღწევების გამოყენება, როგორიც არის: ბლოკჩეინი, ხელოვნური ინტელექტი, თანამედროვე სპეციალიზირებული სისტემები. მაგრამ, მათ დანერგვამდე აუცილებელია თანამედროვე ტექნოლოგიების ბანკის საქმიანობაზე ზეგავლენის და გამოყენების ეფექტიანობის შეფასება, რისი განხორციელებაც საკმაოდ რთულია. არსებობს სხვადასხვა მეთოდები, მაგრამ ერთ-ერთ საუკეთესო გზას წარმოადგენს ბანკის საქმიანობის ბიზნეს-პროცესების შემუშავება და შეფასება, რომლებშიც გათვალისწინებულია თანამედროვე ტექნოლოგიების გამოყენება. ბიზნეს-პროცესი მისი მოდელირების მეშვეობით იძლევა საშუალებას შეფასდეს ამა თუ იმ ინსტრუმენტის გამოყენების ეფექტიანობა. ნაშრომში დახასიათებულია იტ-ის თანამედროვე სისტემები და ტექნოლოგიები, რომელიც გამოიყენება საბანკო სექტორის მოწინავე ინსტიტუტებში. მაგალითისთვის მოყვანილია კრედიტებთან მუშაობის ოპერაციები. დამუშავებულია ბიზნეს-პროცესი ტრადიციული ინფორმაციული სისტემის გამოყენებით, ასევე შემუშავებულია საკრედიტო საქმიანობაში ერთ-ერთი ინოვაციური სპეციალიზირებული სისტემის გამოყენების ბიზნეს-პროცესი. წარმოდგენილია ბიზნეს-პროცესების მოდელები, მათი სიმულაცია და სიმულაციის შედეგები. შედეგების საფუძველზე შესაძლებელია შეფასდეს სპეციალიზირებული სისტემის გამოყენების უპირატესობები. ბიზნეს-პროცესების შეფასების მიდგომა შესაძლებელია სხვა ახალი ინსტრუმენტების გამოყენების შესაფასებლად. მაგრამ, ეს იქნება მხოლოდ ერთ-ერთი ცალკეული მიმართულების შეფასება. თუმცა აქტუალურ საკითხს წარმოადგენს ბანკის საქმიანობის და მასში იტ-ის თანამედროვე მიღწევების გამოყენების კომპლექსური შეფასება. ზოგადად, ბანკის საქმიანობის და მასში IT-ის და ინფორმაციული სისტემების (IS) ეფექტიანობის შესაფასებლად გამოიყენება სხვადასხვა მეთოდები, მაგალითად: Return on Investment (ROI), Total Cost of Ownership, System Usability Scale და სხვა, მაგრამ მხოლოდ Balanced Scorecard (BSC) – იძლევა საშუალებას კომპლექსურად შეფასდეს ბანკის საქმიანობა და, რაც მნიშვნელოვანია, იმ ბიზნეს-პროცესების გათვალისწინებით, რომლებშიც გამოიყენება თანემედროვე IT-ის მიღწევები. Balanced Scorecard (BSC) - მაჩვენებლების დაბალანსებული სისტემის ისტორია დაკავშორებულია Balanced Scorecard კონცეფციის ჩამოყალიბებასთან 1990 წელს, როდესაც მსოფლიოში ცნობილი სააუდიტორო-კონსალტინგური კომპანიის "KPMG Peat Marwick“-ის კვლევით ცენტრში შეუდგნენ იმ შესაძლებლობებისა და ინსტრუმენტების ძიებას, რომელიც უზრუნველყოფდა მართვის ეფექტიანობის ზრდას. ზოგადად, ბიზნეს-პროცესების დონეზე სტრატეგიული საქმიანობის კონტროლი ხორციელდება ე.წ. საქმიანობის კვანძოვანი მაჩვენებლების საშუალებით (Key Performance Indicator - KPI), რომლებიც რეალობაში წარმოადგენენ მიზნების მიღწევადობის საზომს, და ასევე ბიზნეს-პროცესების და თითოეული თანამშრომლის მუშაობის ეფექტიანობის მახასიათებლებს. გამომდინარე აქედან, მაჩვენებლების დაბალანსებული სისტემა (მდს), რომელიც ორიენტირებულია KPI-ების შეფასებაზე, წამოადგენს არა მარტო სტრატეგიული, ასევე ოპერატიული მართვის ინსტრუმენტს. მდს-ს უპირატესობას წარმოადგენს ის, რომ ორგანიზაცია, რომელიც დანერგავს აღნიშნულ სისტემას, ღებულობს მოქმედებების კოორდინირებულ სისტემას, რომელიც შეესაბამება სტრატეგიას მართვის ყველა დონეზე, და აერთიანებს სხვადასხვა ფუნქციონალურ სფეროს, მაგალითად: პერსონალის მართვა, ფინანსები, IT და სხვა. ნაშრომში შემოთავაზებულია ბანკის საქმიანობის ეფექტიანობის შეფასების მიდგომა Balanced Scorecard მეთოდის საფუძველზე. მოყვანილია მისი ძირითადი ნაბიჯები და შემოთავაზებულია ის KPI-ები, რომელიც შეიძლება იყოს გამოყენებული ბანკის ბიზნეს-პროცესების და მათში თანამედროვე IT-ის გამოყენების შესაფასებლად.

Downloads

მ.თევდორაძე, ნ.წულუკიძე, ე.დადიანი, მ.სალთხუციშვილი. თ,რუხაძე, მ.ნებიერიძე. ინფორმაციული ტექნოლოგიების სტრატეგია. საქართველოს ტექნიკური უნივერსიტეტი, გამოცემა 2, 2019 (2021), სტუ-ს ბიბლიოთეკა CD – 6155, 250გვ.

მ.თევდორაძე, მ.სალთხუციშვილი, ს.გოგოლაძე, თ.რუხაძე. ბიზნეს–პროცესების მართვის ინფორმაციული სისტემებისა და ტექნოლოგიების ეფექტიანობა და მისი გავლენა ორგანიზაციის საქმიანობაზე ბანკების მაგალითზე. მონოგრაფია. საქართველოს ტექნიკური უნივერსიტეტი. სტუ, თბილისი, 2017. სტუ–ს ბიბლიოთეკა, CD 3792, 181 გვ.

მ.თევდორაძე, ნ.ლოლაშვილი. საბანკო-საფინანსო ინფორმაციული სისტემები და ტექნოლოგიები. საქართველოს ტექნიკური უნივერსიტეტი, თბილისი, 2019. სტუ-ს ბიბლიოთეკა CD-6155, 280 გვ.

Nona Otkhozoria, Taliko Zhvania, Nino Lortkipanidze The Critical Role of Information Technology Service Management Using ITIL Best Practices to Improve Business Management Computer Science https://doi.org/10.36073/1512-0996-2024-2-171-176

მ.თევდორაძე,ნ.მელიქიძე, ნ.ღუდუშაური. ბანკში თანამედროვე ტექნოლოგიების გამოყენების ეფექტიანობის შეფასება. შრომათა კრებული "თანამედროვე გამოწვევები და მიღწევები ინფორმაციულ და საკომუნიკაციო ტექნოლოგიებში - 2024 © საგამომცემლო სახლი "ტექნიკური უნივერსიტეტი", 2024. http://www.gtu.ge. ISBN 978-9941-512-80-3, გვ.42-48

https://www.techtarget.com/searchcio/definition/ROI

https://www.neomind.com.br/en/blog/tco-total-cost-of-ownership-what-it-is-and-how-to-calculate-it/

Aleksandra Bošković, Ana Krstić The Combined Use of Balanced Scorecard and Data Envelopment Analysis in the Banking Industry / Business Systems Research | Vol. 11 No. 1 |2020

მ.თევდორაძე, მ.სალთხუციშვილი, თ.ჭიღლაძე, თ.რუხაძე, მოდელირების როლი ბიზნეს–პროცესების დაპროექტებასა და ოპრიმიზაციაში. მონოგრაფია, სტუ, თბილისი, 2017, სტუ–ს ბიბლიოთეკა, CD 3792, 137 გვ.

საავტორო უფლებები (c) 2025 ქართველი მეცნიერები

ეს ნამუშევარი ლიცენზირებულია Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 საერთაშორისო ლიცენზიით .