საგადასახადო დავის წარმოება საქართველოში

ჩამოტვირთვები

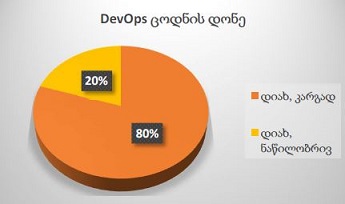

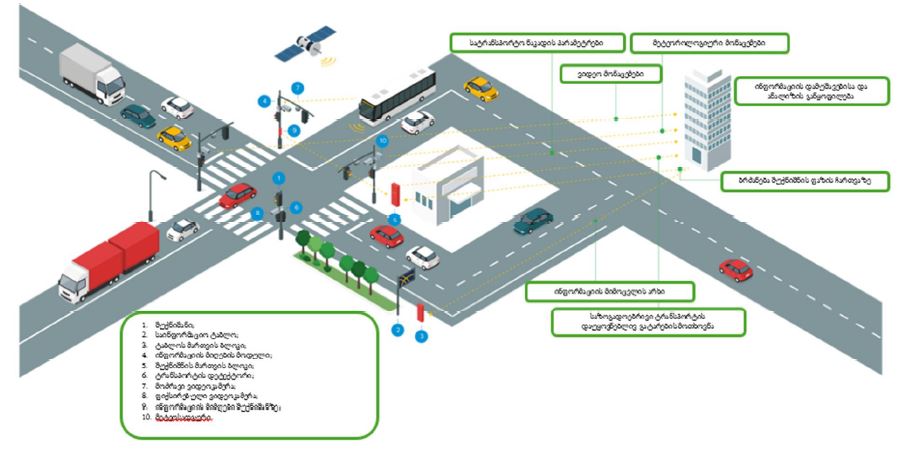

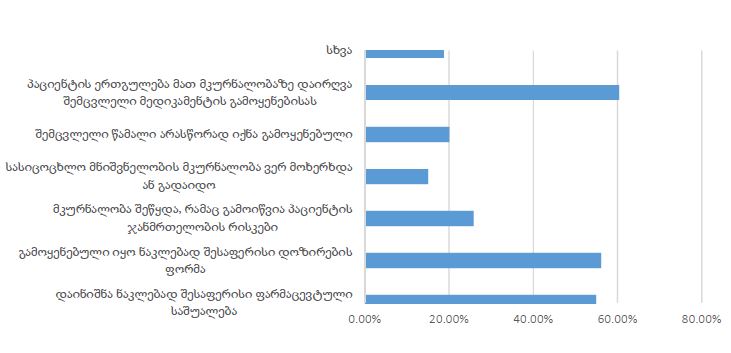

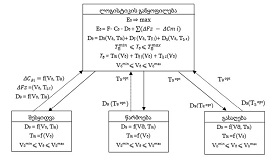

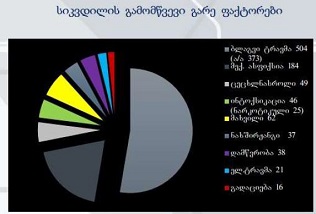

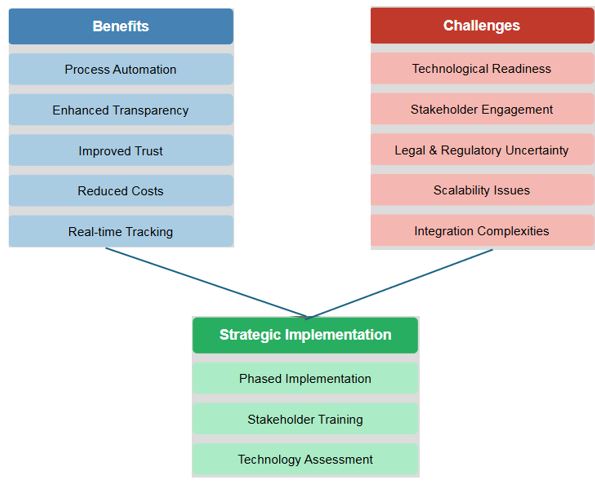

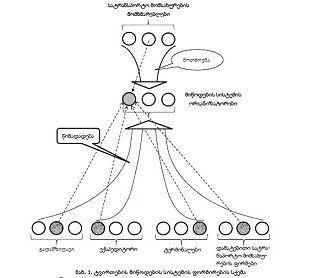

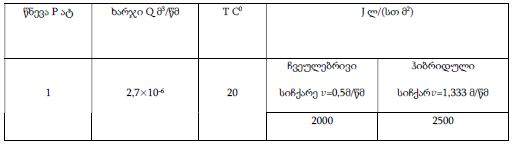

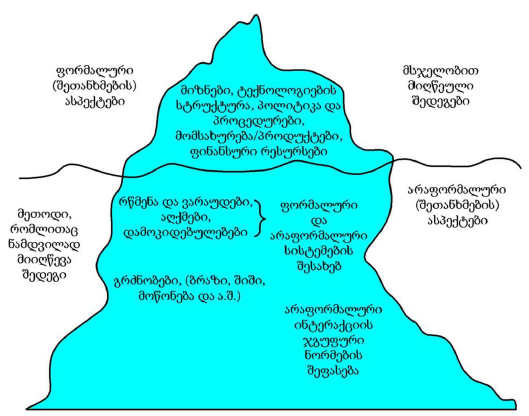

საგადასახადო დავების სამართლიანი და ეფექტიანი გადაწყვეტა ქვეყნის ბიზნეს მიმზიდველობის ერთ-ერთი აუცილებელი კრიტერიუმია. საგადასახადო დავების განხილვა მნიშვნელოვან ინსტრუმენტს წარმოადგენს, რომელიც უზრუნველყოფს გადასახადის გადამხდელთა უფლებების დაცვას. საქართველოში საგადასახადო ორგანოს მიერ დაკისრებული საგადასახადო ვალდებულების გასაჩივრების მსურველი მეწარმეების რიცხვი მაღალია, რაც ზრდის მოლოდინებს საგადასახადო დავების წარმოების, აღსრულების მექანიზმების მიმართ. საგადასახადო რისკების სწორი და ეფექტური მართვა გულისხმობს გაურკვევლობის სფეროების კონტროლს, რათა ბიზნესის მიერ დასახული მიზნების მიღწევა იყოს უფრო გამჭვირვალე და თავიდან იქნას აცილებული დავების წარმოშობა იმ სახელმწიფოების კომპეტენტურ საგადასახადო ორგანოებთან, სადაც კონკრეტული გადასახადის გადამხდელი საქმიანობს. საგადასახადო კანონმდებლობაში განხორციელებული ცვლილებები, რიგ შემთხვევაში, ემსახურება კანონმდებლობის ბუნდოვანი, ორაზროვანი ინტერპრეტაციის მქონე დებულებების აღმოფხვრას, ხოლო რიგ შემთხვევაში, მიმართულია ახალი დაბეგვრის მექანიზმის შემუშავებისკენ. ეს უკანასკნელი, გადასახადის გადამხდელების მიერ სათანადო ცოდნას, ცვლილების მიმართ გარკვეული მზაობის არსებობას, დროულ ადაპტირებას მოითხოვს, რაც ყოველთვის ვერ ხორციელდება წარმატებულად და პირდაპირ თუ ირიბად, რიგ შემთხვევაში, წარმოქმნის საგადასახადო დავას. დავის განმხილველი ორგანო ვალდებულია იხელმძღვანელოს სამართლიანობის, ობიექტურობის, მხარეთა თანასწორობისა და მიუკერძოებლობის პრინციპებით. სისტემაში საგადასახადო დავის შედეგად დაუშვებელია მომჩივნის საგადასახადო ვალდებულებების დამძიმება, გარდა გადამხდელის თანხმობით ამავე დავის ფარგლებში ჩატარებული შემოწმების შემთხვევისა.

Downloads

Dr. Nur Hidayat, SE, ME, Ak, - Corporate Tax Risk Management. Elex Media Komputindo, 2015

Michael Heimig - Tax Risk Management im Konzern. Springer Fachmedien Wiesbaden, Mar 6, 2019 - Business & Economics - 367 pages

საგადასახადო დავების ანალიზი; USAID GEORGIA აშშ-ის საერთაშორისო განვითარების სააგენტოს პროექტი ,,მმართველობა განვითარებისათვის“ (2016)

,,საქართველოს მცირე და საშუალო მეწარმეობის განვითარების სტრატეგია 2021-2025 წლებისთვის“- საქართველოს ეკონომიკისა და მდგრადი განვითარების სააგენტო https://bit.ly/3NRk8Ut

თ.კოპალეიშვილი, მ.ჩიკვილაძე. ,,გადასახადები და დაბეგვრა“, ივ. ჯავახიშვილის სახელობის თბილისის სახელმწიფო უნივერსიტეტი, თბილისი 2011

ფინანსთა სამინისტროს სისტემაში განხილული დავების სტატისტიკა - https://taxdisputes.gov.ge/4045

საავტორო უფლებები (c) 2025 ქართველი მეცნიერები

ეს ნამუშევარი ლიცენზირებულია Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 საერთაშორისო ლიცენზიით .