Risk Estimation Model for the Wine and Spirits Sector

Downloads

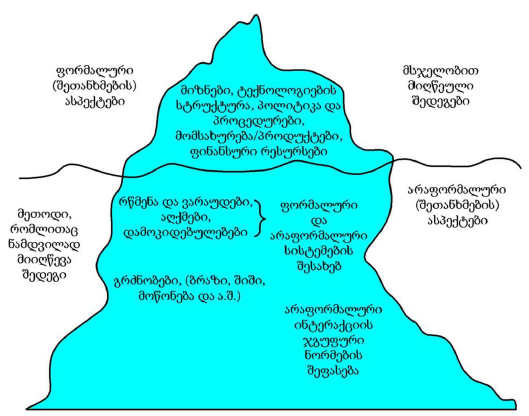

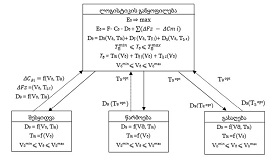

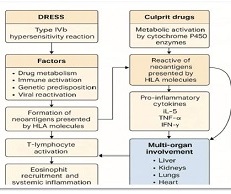

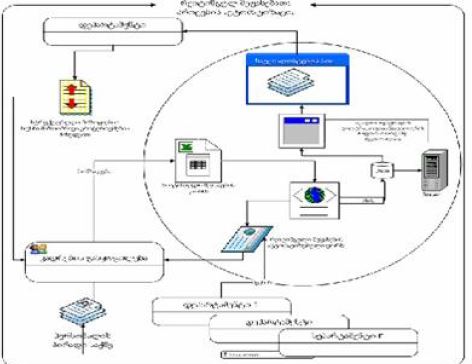

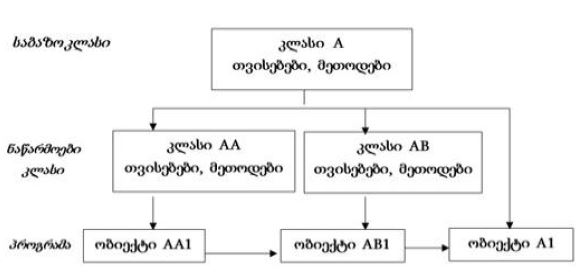

Risk is an integral part of people and business. A source of risk is any event, in the case of which the company experiences a financial loss, which may lead to a decrease in the company's purchasing power and increase the liquidity risk, what negatively affects the company's strategic goals and objectives. For business, a crisis is associated with an uncertain and significant event that threatens the operational, reputational and financial stability of the company and has a negative impact on its continuous development. In order to protect the principle of business functionality during the crisis period, it is important to implement a quick and effective response by the management and develop a risk management model that should ensure the effective risk management process. In the crisis period, the occurrence of undesirable consequences for the business is related to internal and external risks. The external risks of the country lead to the increase of the internal risks of the companies. In particular, increased competition, low rate of economic growth and deteriorating social conditions may lead to an increase in transportation, supply, production and operational risks, which will lead to questioning the principle of business functionality. During the crisis, most of the companies find it difficult to properly manage risks, because risk management is a multi-step and complex process.

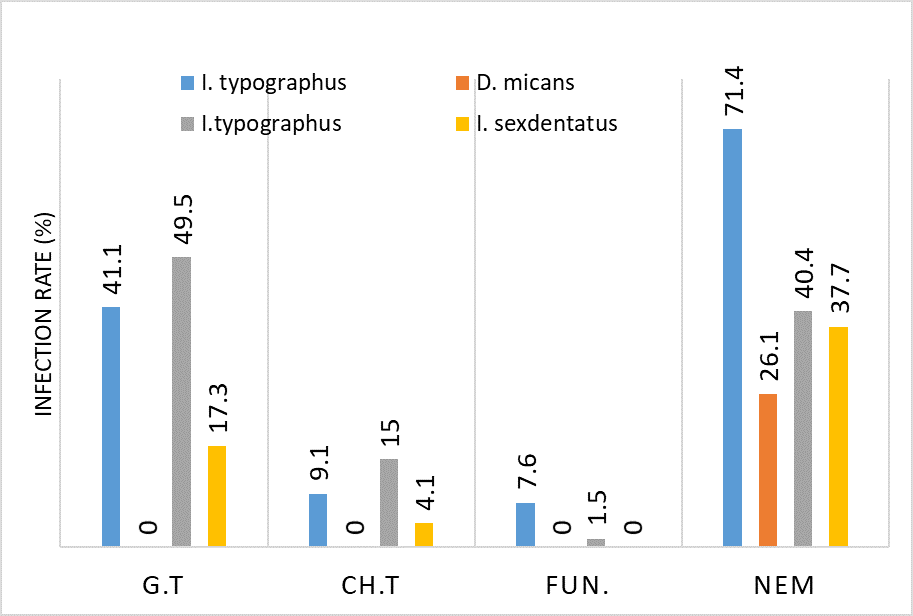

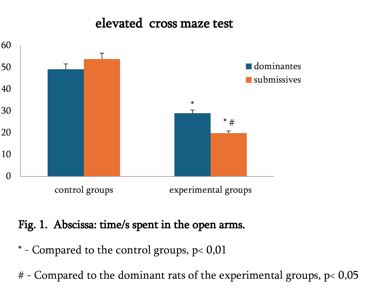

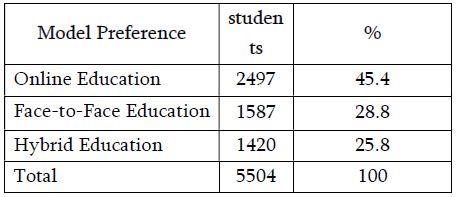

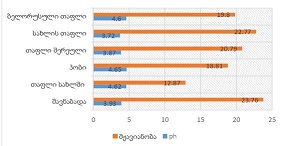

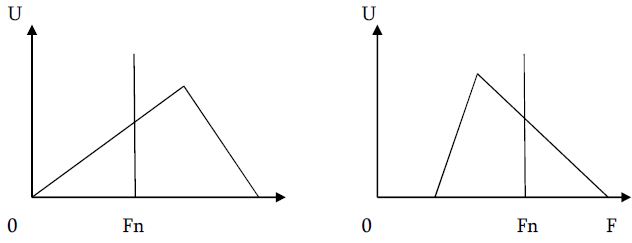

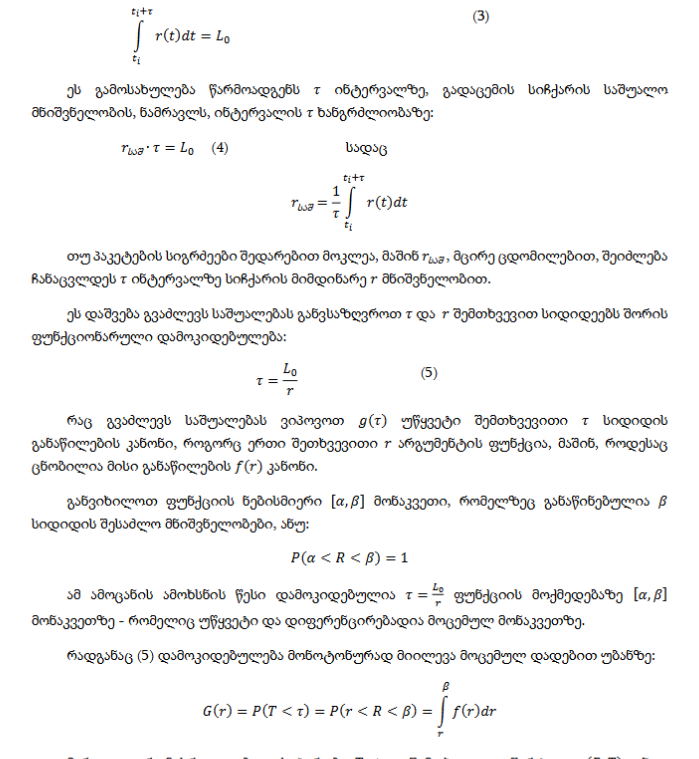

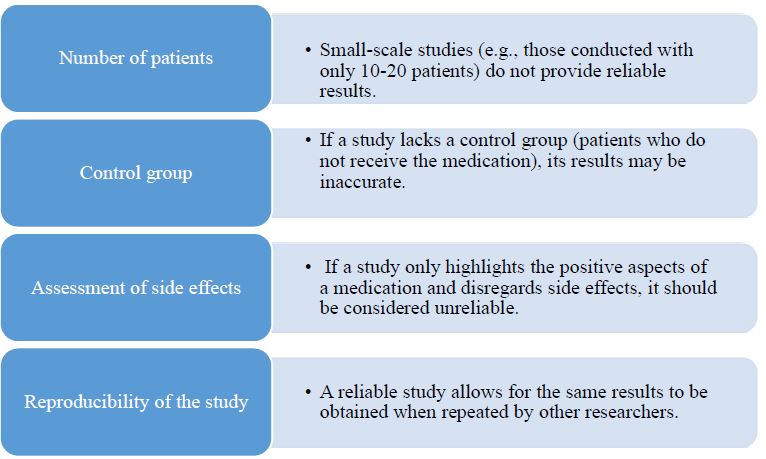

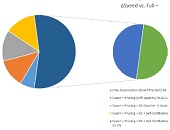

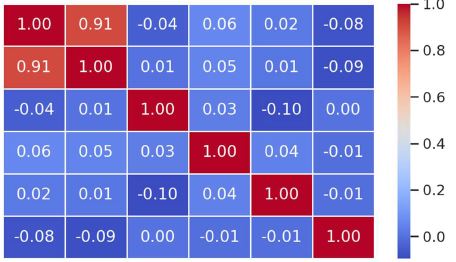

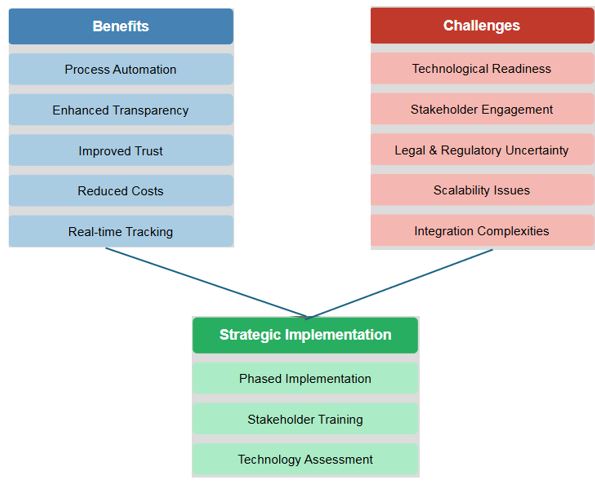

The level of risk importance is determined by two main factors:

- Probability of risk occurrence;

- The impact of risk, that is, the impact of a negative result on the company's goals and objectives.

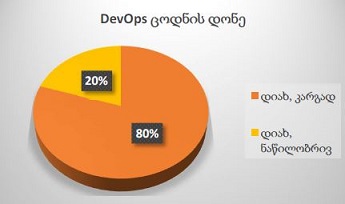

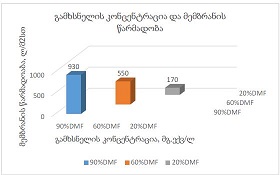

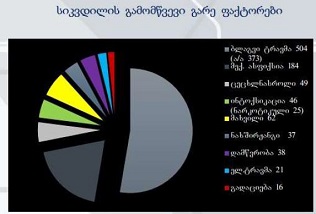

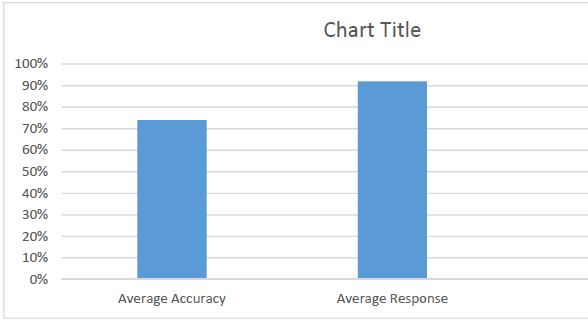

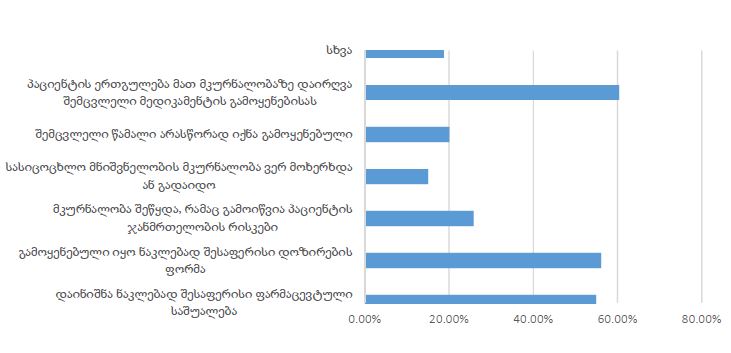

Taking into account the combination of probability and impact of risks for the alcoholic beverages sector in Georgia, the paper proposes to categorize them according to priorities and develop a quantitative method of assessment and a scale of permissible risk is given.

The following are estimated:

- Risks that are highly likely to occur and have a high impact on the goals and objectives set by the company. Those are considered as priority risks and should be given great attention;

- Risks that have probability of occurrence and impact on the company's strategic goals and operational principles a little. Those are considered as less priority risks and less attention would be paid to them;

- Risks that have a high probability of occurrence and a low impact, and conversely, a risks that have a low probability of occurrence and a high impact. Determining the order of their priorities should be based on the company's strategic goals and objectives.

Downloads

Cherunilam, F. (2017). Business Policy and Strategic Management. Mumbai: Himalaya Publishing House.

Hopkin, P., Thompson, C. (2021). Fundamentals of Risk Management Understanding, Evaluating and Implementing Effective Enterprise Risk Management. Kogan Page.

Horngren, C., Sundem, G., Elliott, J., & Philbrick, D. (2006). Introduction to Financial Accounting. New Jersey: Pearson Education.

Porter, M. (1980). Competitive strategy: techniques for analyzing industries and competitors. New York: Free Press.1.

ჭილაძე, ი. (2018). ფინანსური ანგარიშგების ანალიზი. თბილისი: თსუ გამომცემლობა.

სს „თბილღვინოს“ 2020 წლის ფინანსური ანგარიშგება. https://reportal.ge/ka/Reports/ GetFile/31847.

Copyright (c) 2024 Georgian Scientists

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.